Restructuring solutions via insolvency proceedings

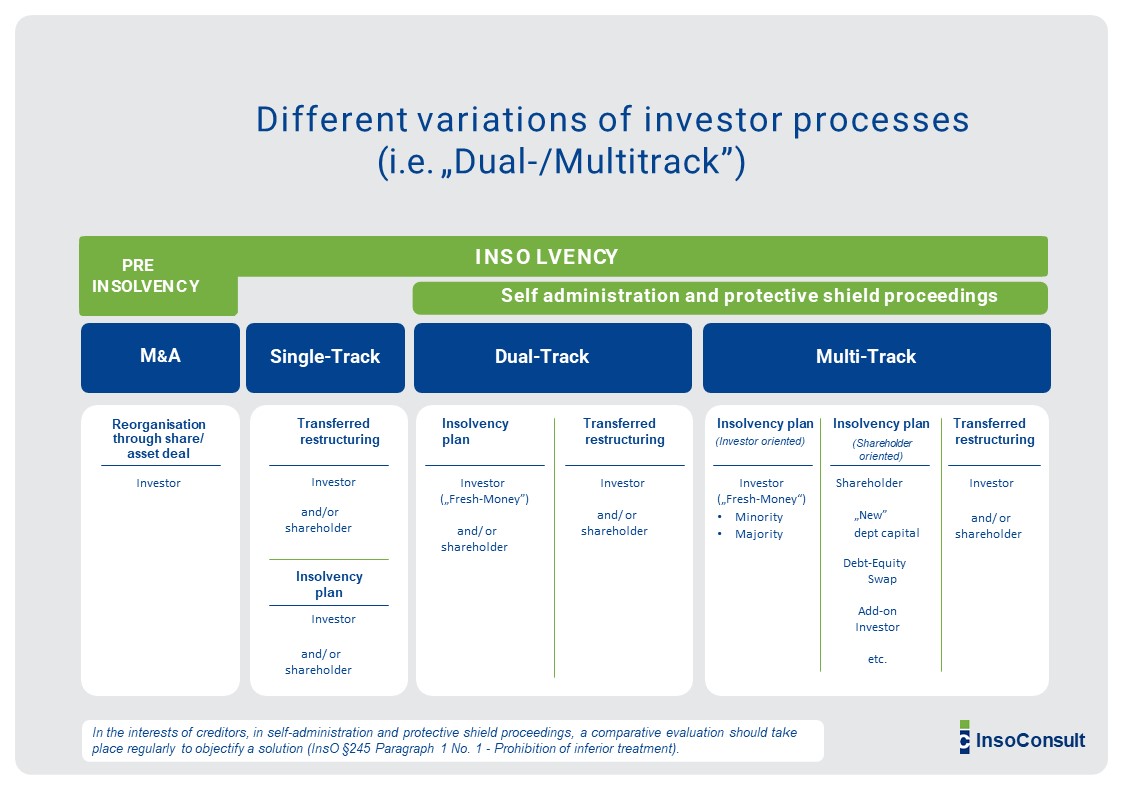

The paradigms and opportunities for distressed M&A-advisory have changed significantly since the introduction of ESUG in March 2012. With self-administration and protective shield proceedings (§270b / 270d InsO) the options of action became multi-layered and the implementation possibilities have grown more complex.

Regardless of the restructuring path chosen, it is almost always necessary to find an investor who is willing to reduce the debt, fund the restructuring concept and close the fiscal gap with “fresh money”.

The central task of distressed M&A activities is the identification of suitable investors or acquirers. InsoConsult provides insolvency administrators, creditors and entrepreneurs with the implementation of proven, creative investor processes, which consistently take into account all time-critical legal and economic aspects of restructuring solutions.

Our strength is to present the healthy core of a company to potential investors and to convey the strategic relevance. The sustainability of our solutions for employees and shareholders of the NewCo as well as the satisfaction of the creditors, represents the essential success factor of restructuring in insolvency.

Standard insolvency proceedings – asset deal

Our reputation is based on many years of experience in implementing investor processes for standard insolvency proceedings, which are carried out on behalf of insolvency administrators and creditors. The transfer of business activities to a new corporate entity by means of an asset deal (Übertragende Sanierung) shall be realised in the shortest possible time. The overall demands concerning M&A consultants are challenging, requiring reliable and well-established processes. Proven and tested instruments, many years of experience and a high level of pragmatic decision-making lead to a sustainable success in these high-pressure phases.

Our name/reputation stands for transparent and customer-value-oriented solutions through the creation of competitive situations in bidding processes and the objectification of MBO solutions.

Creating successful transactions while balancing the vested, often conflicting objectives of shareholders and management, creditors, insolvency administrators, customers and suppliers is our daily practice.

Restructuring by transferring assets, provides investors with multiple advantages such as shortened due diligence periods, easier valuation and higher transparency concerning the assets to be taken over, simple deal structures and a high level of legal certainty.

Insolvency proceedings under self-administration,

protective shield or insolvency plan proceedings

The paradigms for M&A services have changed significantly since the introduction of ESUG in March 2012 due to the possibility of self-administration (§270b InsO) or protective shield proceedings (§270d InsO).

As a result, insolvency plan proceedings in particular have gained importance. Proprietarily funded and negotiated debt settlement in combination with a source of fresh money have become key issues.

Finding the right balance between sufficient creditor satisfaction, shareholder interests and the chance to achieve financial stability is the most crucial objective when generating an investor solution.

InsoConsult synchronizes the all too often diverging objectives and interests of all participants by moderating a consensus-oriented dialogue.

Open-ended transaction processes, also known as dual / multitrack investor processes, are perfectly suitable to take all the individual requirements into account and to identify alternative solutions for stability and future growth of the distressed company.

M&A Advisory

IC Transaction Partners is our business division which specializes on M&A transaction advisory.

The experienced team of IC Transaction Partners combines skills and proven expertise in balance sheet analysis, enterprise valuation and in drafting individual transaction processes expertise. Our discrete approach and a vast network of partners are our key success factors for M&A transactions.

Sell-side Advisory (Divestments – Company Succession Planning)

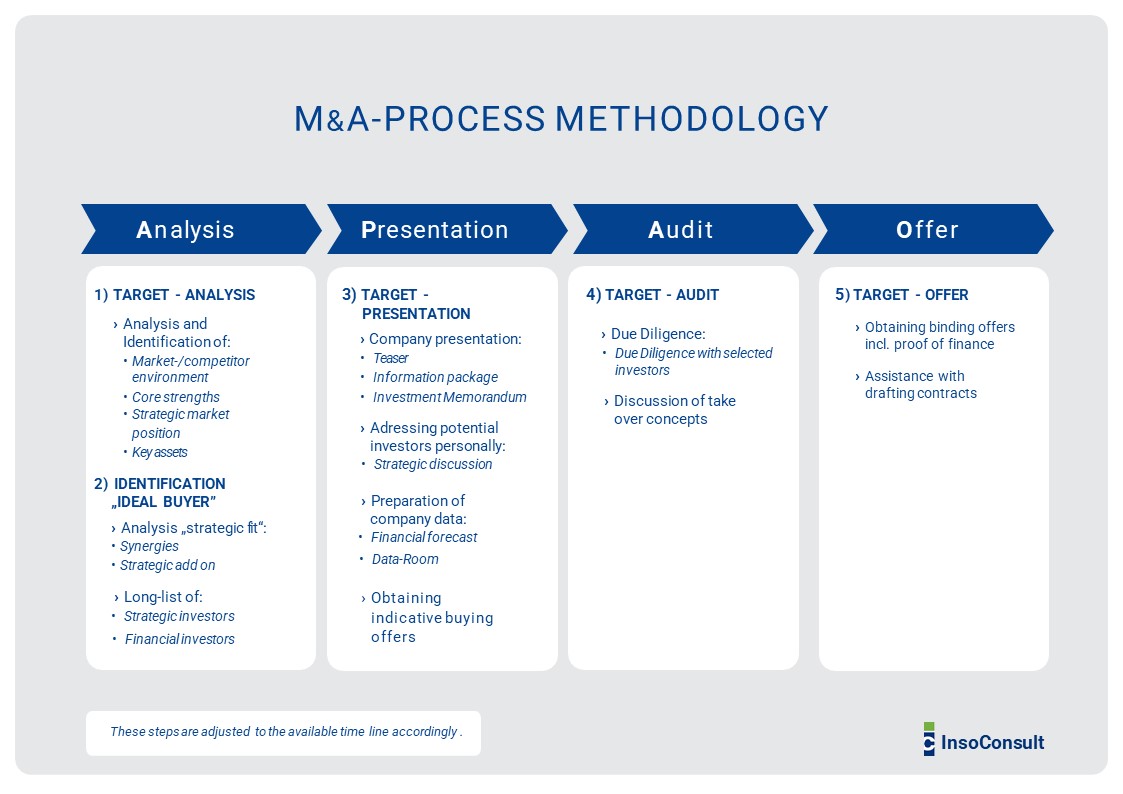

IC Transaction Partners have profound research knowledge for identifying potential buyers with the highest strategic need for a specific target company.

We introduce potential buyers with a broad strategic benefit to the selling party and help to create secure sustainable soultions with maximized selling prices.

We support entrepreneurs and shareholders in the presentation of their companies, emphasizing the key strengths and core values in all transaction documents and brochures.

IC Transaction Partners use a comprehensive set of tools for balance sheet analysis (identification of hidden reserves), the monetary assessment of the market position as well as the preparation of individualized investors brochures, documents and data-rooms.

We have a long-standing experienced international network which supports us in the realization of complex transactions.

Buy-Side Advisory (Acquisitions)

IC Transaction Partners provide buy-side advisory for acquisition-oriented companies by identifying and analysing potential targets.

Being pro-active senior market participants, we continuously research and screen market activities and trends. With our extensive network of corporate and banking contacts, we guarantee early-stage access to new investment opportunities.

IC Transaction Partners look back on a long track record of successful national and international M&A transactions.

Strategic investors

For strategic buyers, IC Transaction Partners develop “growth acquisitions” to enable an expansion of their current business activities by entering new business sectors, customer groups and geographic markets.

Financial investors

We support financial investors with vertical and horizontal portfolio add-ons by identifying appropriate targets with a high production- or sales-fit.

Restructuring, Reorganisation and Corporate Finance

Prior to potential corporate finance or M&A activities, several guiding questions regarding reorganization and restructuring have to be disccussed. Insoconsult offers a variety of services in cooperation with partners for restructuring and financing, legal, tax, auditing and interim management: